Credit Co-operative society

A credit cooperative society is a type of credit society that is controlled by and owned by its members. Credit cooperative societies are registered with the primary goal of advancing the economy and society via the provision of affordable credit and financial services to their members.

Agriculture Credit Societies

These social structures are common in rural areas. These associations would lend money to local farmers and artisans.

Non-Agriculture Credit Societies

There are non-agricultural credit societies in urban and metropolitan areas. Individuals in these places can get these loans.

Agriculture Credit Societies

These social structures are common in rural areas. These associations would lend money to local farmers and artisans.

Non-Agriculture Credit Societies

There are non-agricultural credit societies in urban and metropolitan areas. Individuals in these places can get these loans.

Introduction to credit cooperative society

Registration of a credit cooperative society generally involves doing so in accordance with legal requirements and with a group of people who share your goal. For a credit cooperative society, society registration is crucial. A multi-state cooperative society includes various forms of cooperative societies, one of which is the credit cooperative society. Visit the MSCS website to get the form 1 establishing a multi-state cooperative society. Compared to other registrations, the credit cooperative society registration requires less paperwork. These societies do lend money to its members for social and economic advancement. You gain access to these lending services thanks to the registration of credit cooperative societies. Everyone prefers legal societies above other types.What does a credit cooperative society do?

The registration of the credit cooperative society enables it to carry out activities that are beneficial to society:- They were established to provide members with financial help.

- Their main responsibility is to firmly uphold the rights of producers and consumers (Rural people).

- Collects deposits from customers.

- They frequently eliminate the extra revenues that middlemen in commerce and trade bring in.

- Offers the member loans with affordable interest rates. (Loan for a house, personal items, a car, etc.)

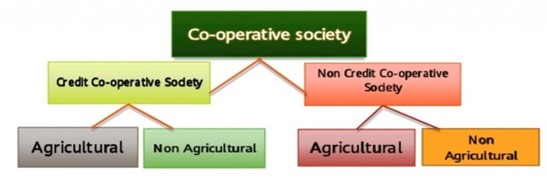

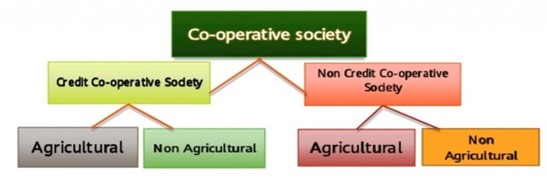

Types of credit cooperative society

Agriculture Credit Societies

These social structures are common in rural areas. These associations would lend money to local farmers and artisans.

Non-Agriculture Credit Societies

There are non-agricultural credit societies in urban and metropolitan areas. Individuals in these places can get these loans.

Agriculture Credit Societies

These social structures are common in rural areas. These associations would lend money to local farmers and artisans.

Non-Agriculture Credit Societies

There are non-agricultural credit societies in urban and metropolitan areas. Individuals in these places can get these loans.

Tier Category of Credit Co-operative Society

There are different tiers related to category for credit co-operative societies. The following are the types of tiers present under Credit Co-operative societies:

- Primary Credit Cooperative Society: is a group of people who are borrowers and non- borrowers living in a specific locality. Membership for the residents of the locality is open for all. Plus, they take an interest in the business affairs of one another.

- Central Credit Cooperative Society Banks: A central credit co-operative society is a group of people where the membership of the central co-operative bank is restricted to primary societies only. That is also known as banking union .Now, people are also allowed as members of nearly all Central Co-operative Banks.

- State credit Cooperative Banks society: State credit Cooperative Banks society is formed with the aim of inviting deposits from the wealthy urban classes. They are the mediator between the joint stock banks and the co-operative movements.

What is the benefit of Credit Cooperative Society Registration?

- Forming The Credit Co-Operative Society is simple. Ten or more adults can interact to create a society. Additionally, it’s simple and comfy to register for a credit cooperative organisation. The finest thing is that there aren’t many legal requirements to follow for its formation.

- There is no barrier to joining unless specifically stated. Everyone is welcome to join such an organisation without paying a fee. No one is excluded because of their gender, creed, colour, caste, or religion. Anyone can join society at any time and integrate into it.

- A spirit of self-sufficiency is increasingly being propagated thanks in large part to credit cooperative societies. They consider the economic well-being of the less developed rural sector of the population.

- They excel at striking a balance between the business units’ stability and the conviction that serving the members is the only sincere way to achieve financial security. It is necessary for the formation of a society to register.

- In the creation of a credit cooperative society, the liability is constrained. A member’s obligation is capped at the amount of capital they have donated to society. This benefits the members because they won’t have to worry about losing their own assets and property in the event that the society suffers a loss.

- Also important to consider is the LLP Registration.

- Credit cooperative society: Fully governed by members who have been elected among themselves. Everybody is entitled to the same rights at all times. They are able to actively participate in the creation or adjustment of societal policies. This demonstrates the democratic management of the credit cooperative society and the equal importance of all members.

Procedure for Registering a Credit Co-operative Society

How to register a credit cooperative society:- The credit co-operative society is supported by a certificate from the bank stating the credit balance.

- There must be a minimum of 50 members in each state.

- There should be a minimum of 7 and a maximum of 21 board members.

- the name and list of promoter members.

- The intense inquiry letter’s No Objection Certificate (NOC) is granted.

- 4 copies of the sample bylaw.

- Details and a copy of the decision from the pre-registration meeting. This covers the funding, participants, board, operation, etc.

- the suggested name by your credit cooperative society’s members.

- The head office address’s specifics must be recorded.