GST Registration in Bangalore

Goods and Services Tax (GST) registration is mandatory for businesses in India whose turnover exceeds the prescribed threshold. Here’s a complete guide to GST Registration in Bangalore.

Who Needs GST Registration?

- Businesses with Turnover Above Threshold:

- ₹40 lakh for goods suppliers (₹20 lakh for special category states).

- ₹20 lakh for service providers (₹10 lakh for special category states).

- E-commerce Operators & Sellers

- If you are selling products or services online through online platforms or on your own website, GST registration is mandatory, regardless of turnover.

- Interstate Business Transactions

- Who Needs GST for Interstate Transactions?

Manufacturers, Traders & Wholesalers shipping goods to another state, Service providers offering services in multiple states, drop shipping & E-commerce sellers selling across states, Interstate stock transfers between branches of the same business.

- Casual Taxable Persons & Non-Resident Taxable Persons

- You must register for GST as a Casual Taxable Person (CTP) or Non-Resident Taxable Person (NRTP) if you are temporarily providing products or services in India without an established location of business.

- A person who occasionally provides products or services in a state or union territory without an established place of business is known as a casual taxable person.

Examples of CTP:

- Businesses participating in trade fairs, exhibitions, or seasonal markets

- Contractors working in different states on a short-term basis

- Event organizers conducting one-time events in a state

- A Non-Resident Taxable Person (NRTP) is an individual or business based outside India but supplying goods/services in India.

Examples of NRTP:

- Foreign companies supplying goods/services in India

- International event organizers

- Foreign businesses providing software or digital services in India

- Businesses Under Reverse Charge Mechanism

- The buyer of goods or services, not the supplier, is in charge of paying GST under the Reverse Charge Mechanism (RCM). Even if their sales are below the threshold, businesses that come under RCM are required to register for GST.

- Who Needs GST Registration Under RCM?

- Businesses purchasing goods/services under RCM

- Specified categories of goods/services under RCM

- Registered dealers buying from unregistered suppliers

- E-commerce operators liable to collect GST

Documents Required for GST Registration

- For Proprietorship

- PAN Card: PAN of the proprietor.

- Aadhaar Card: Aadhaar of the proprietor.

- Photograph: Passport-sized photograph of the proprietor.

- Proof of Business Address:

- Rent agreement (if rented) along with a NOC from the owner.

- Electricity bill, property tax receipt, or municipal khata copy.

- Bank Account Details:

- Cancelled cheque or bank statement with the proprietor’s name, account number, and IFSC code.

- Business Proof (if applicable):

- Shops and Establishment Act certificate.

- Trade license or any other business registration document.

- For Partnership Firms & LLPs

For Partnership Firms:

- PAN Card: PAN of the partnership firm.

- Partnership Deed: Copy of the partnership deed.

- Proof of Business Address:

- Rent agreement (if rented) along with a NOC from the owner.

- Electricity bill, property tax receipt, or municipal khata copy.

- Bank Account Details:

- Cancelled cheque or bank statement with the firm’s name, account number, and IFSC code.

- Authorized Signatory Details:

- PAN, Aadhaar, and photograph of the authorized signatory (partner).

- Letter of authorization or board resolution appointing the authorized signatory.

- Registration Certificate (if applicable):

- Shops and Establishment Act certificate or trade license.

For LLP Registration:

- PAN Card: PAN of the LLP.

- Certificate of Incorporation: Issued by the Ministry of Corporate Affairs (MCA).

- LLP Agreement: Copy of the LLP agreement.

- Proof of Business Address:

- Rent agreement (if rented) along with a NOC from the owner.

- Electricity bill, property tax receipt, or municipal khata copy.

- Bank Account Details:

- Cancelled cheque or bank statement with the LLP’s name, account number, and IFSC code.

- Authorized Signatory Details:

- PAN, Aadhaar, and photograph of the authorized signatory (designated partner).

- Letter of authorization or board resolution appointing the authorized signatory.

3. For Private Limited & OPCs

- Company Documents:

- PAN Card of the company

- Certificate of Incorporation issued by MCA

- Memorandum of Association (MoA) & Articles of Association (AoA)

- Board Resolution or Authorization Letter for the signatory

- Director/Authorized Signatory Documents:

- PAN & Aadhaar Card

- Passport-size photograph

- Address proof (Voter ID, Passport, or Driving License)

- Business Address Proof:

- If owned: Electricity bill, Property Tax receipt, or Sale Deed

- If rented: Rent Agreement + Electricity bill

- For virtual office: NOC from the owner + Utility Bill

- Bank Account Proof:

- Bank statement or Cancelled Cheque with the company’s name.

- Company Documents:

Benefits of GST Registration

Registering for GST in Bangalore offers several advantages for businesses, especially in a rapidly growing commercial hub. Here’s why GST registration is beneficial:

- Legal Compliance & Business Credibility

- Mandatory for businesses with turnover above ₹40 lakh (goods) or ₹20 lakh (services)

- Enhances business reputation when dealing with clients and suppliers

- Helps in securing loans and business funding

- Input Tax Credit (ITC) Benefits

- Allows businesses to claim ITC on purchases, reducing tax liability

- Eliminates the cascading effect of multiple taxes, leading to cost savings

- Expansion & Interstate Business Opportunities

- Enables interstate trade without restrictions

- Required for e-commerce sellers.

- Essential for Import/Export businesses in Bangalore

- Competitive Advantage

- Attracts corporate clients who prefer GST-registered vendors

- Makes business transactions transparent and tax-compliant

- Allows seamless integration with digital payments & financial tools

- Easier Compliance & Centralized Tax System

- One Nation, One Tax simplifies compliance

- Online filing of GST Returns, payments, and refunds reduces paperwork

- GST registration replaces multiple state and central taxes

- Eligibility for Government Tenders & Contracts

- Many corporate and government contracts require GSTIN

- Essential for businesses working with Bangalore Metro, BBMP, Tech Parks, and IT companies

- Access to Global Markets

- Required for exports and international trade

- Helps in claiming GST refunds on exports under zero-rated supply

Online Registration Process:

- Visit the website: www.gst.gov.in

- Click on SERVICES > REGISTRATION > NEW REGISTRATION

- Enter the following information – New Registration window enter the following information

a. I am a –In this select the type of registration being sought. Select Taxpayer for

getting a normal registration in GST.

b. State/UT – Select the State or union territory in whichregistration is being sought.

c. District – Select the district.

d. Legal Name of the Business – Enter the name as mentioned in PAN Card. A person applying as Tax Deductor under GST can also use TAN instead of PAN.

e. Permanent Account Number – Enter PAN No.

f. Email Address – Enter an email address. Email should be valid and accessible as GST portal/department will send OTP to this email for future transactions.

g. Mobile Number – Enter mobile number, GST portal/department will send OTP to this number for future transactions.

Click on PROCEED.

Two (2) separate OTPs will be received on email and mobile number on the details mentioned above. Enter the OTP’s received and you will receive a TRN on email and mobile no.

4. Repeat step 2, instead of NEW REGISTRATION click on TEMPORARY REFERENCE NUMBER (TRN). Now enter the TRN received on your email or mobile. Enter CAPTCHA code and click on PROCEED.

5. Enter OTP received on your mobile or email. This OTP will be the same on both. Click on PROCEED.

6. Now in the DASHBOARD you will see My Saved Applications, in that click on the Action button.

7. Now the Registration Application Form will open. This form is valid for 15 days from the last saved date until submitted. It has 10 tabs namely:

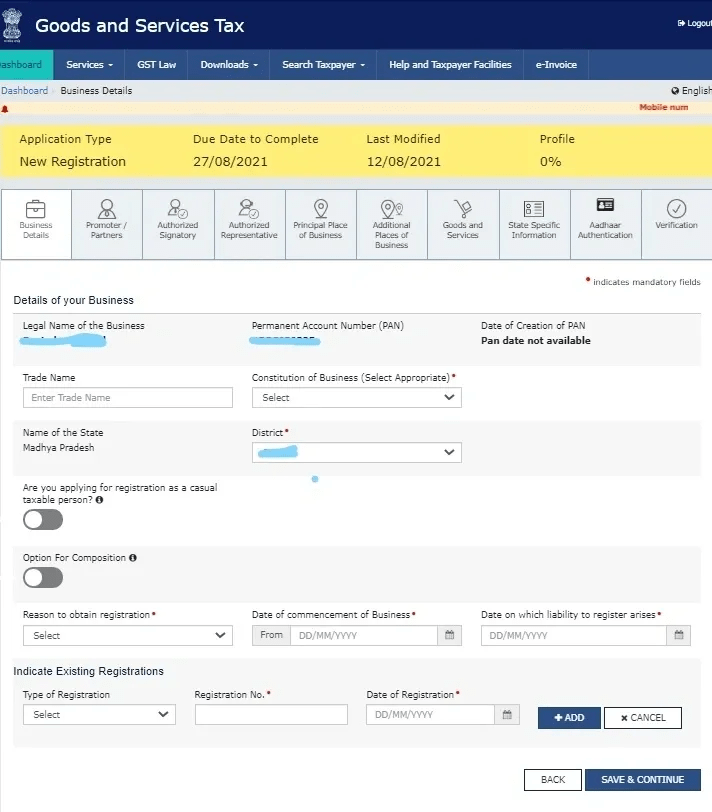

a. Business Details

b. Promoters/Partners

c. Authorised Signatory

d. Authorised Representative

e. Principal Place of Business

f. Additional Places of Business

g. Goods and Services

h. State Specific Information

i. Aadhaar Authentication

j. Verification

Explaining each Tab in detail:

A. Business Details:

I. Legal Name of Business – This will be auto-populated from the information mentioned in step 3.

II. Permanent Account Number –This will be auto-populated from the information mentioned in step 3.

III. Date of Creation of PAN –This field will be auto-populated. Sometimes it may show PAN date not available, it is not a concern to proceed further.

IV. Trade Name –Here Trade Name i.e. the name by which business is being run. This name is different from the Legal Name. It is an optional field.

The legal and trade name can be different.

V. Constitution of Business – Select the type of business. Ex. Individual, Partnership, Private limited company etc.

VI. Name of the State- This field is auto-populated from the information mentioned in step 3.

VII. District – Select the appropriate district.

VIII. Are you applying for registration as a casual taxable person? – Select ‘Yes’ or ‘No’ based upon the registration being sought.

IX. Option for Composition – Select ‘Yes’ or ‘No’ depending on whether the composition scheme is being opted or not.

X. Reason to Obtain Registration – From the drop-down menu select the reason for registration. Kindly refer to previous posts for identifying reasons which suit you.

XI. Date of Commencement of Business – Enter the date on which business was started. This date should be the business commencement date not the date on which you apply for GST registration or become liable for GST registration.

XII. Date on Which Liability to Register Arises – Enter the date on which you become liable to register under GST. Kindly refer to previous posts for identifying the date on which your liability to register arises.

XIII. Indicate Existing Registrations – If the person has any other registration under any other law in force, then the same shall be mentioned here. Ex. registration under VAT, Excise, Companies Act, LLP Act etc.

Click on ‘SAVE & CONTINUE’

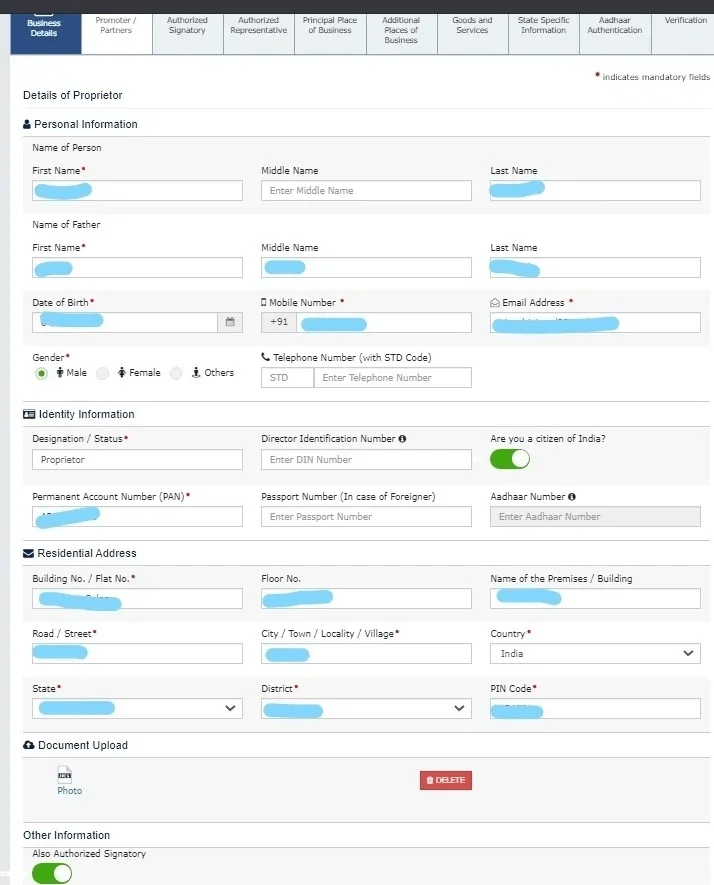

B. Promoters/Partners

- Personal Information – Enter personal information of Proprietor, Partner, Promoter, Director etc. Kindly ensure that this information i.e. Name, Father’s Name, DOB, and Gender should be the same as in PAN. Enter valid email and mobile no. of the promoter, partner etc. If you wish to opt for AADHAAR authentication then this information should be as per Aadhaar.

- Identity Information – Enter identification details of the promoter, partner etc. as

follows:- Designation/Status –Mention the relation of the person with the business i.e. Director, Proprietor, Partner, Owner, Managing Director etc.

- Director Identification Number- In case of Company or LLP enter the DIN or DPIN of the director or designated partner as the case may be.

- Are you a citizen of India? – Select ‘Yes’ or ‘No’

- Permanent Account Number – Enter PAN of the above-mentioned person.

- Passport Number – In case a person is not a citizen of INDIA then it is must to provide his/her passport number.

Note: PAN no. is a mandatory field for a person who is a citizen of INDIA. But when

the No is selected in (c) above then PAN is removed as a mandatory field and

PASSPORT number becomes a mandatory field.

- Residential Address – Enter the residential address of promoter, partner etc. This address should be supported by valid address proof. If you wish to opt for AADHAAR authentication then this address should be as per aadhaar.

- Document Upload – Upload photo of promoter/partner etc.

- Also authorised signatory – If the same person is also authorised to file GST returns or perform other obligations under GST for the business then select ‘Yes’. If the person required to do such acts is a different person then select ‘No’.

Click on “SAVE & CONTINUE’

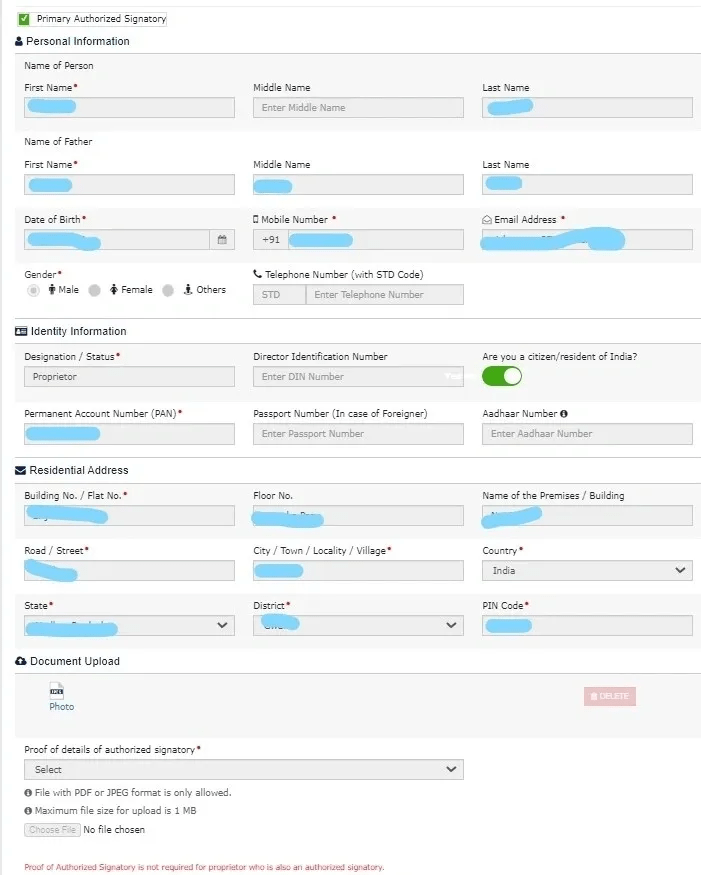

C. Authorised Signatory

(i) Primary Authorised Signatory – Select this option for the authorised signatory who

will be primarily communicating with GST department. This is to be selected even if there

is one authorised signatory.

Note: For all other information follow the guidelines as mentioned in Part B.

Promoters/Partners.

Click on ‘SAVE & CONTINUE’

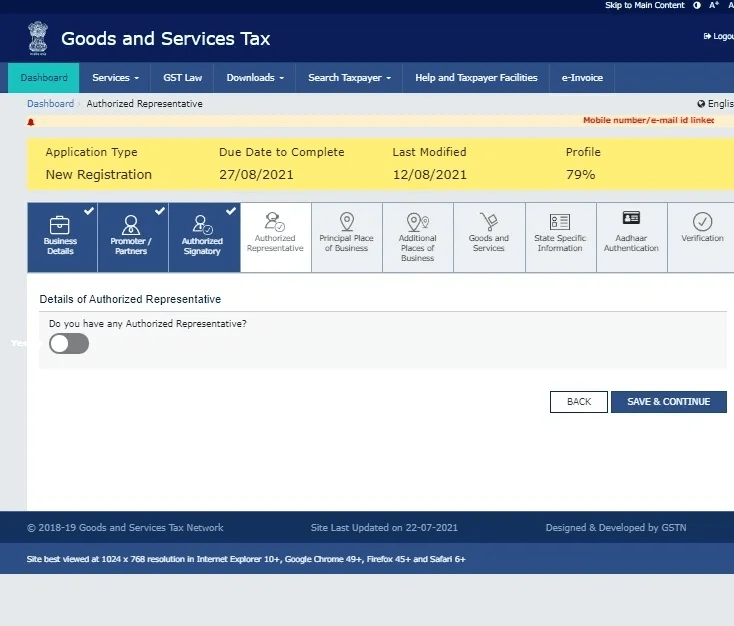

D. Authorised Representative – In this enter details of an authorised representative if you have any. Authorized representative means a person who is authorized by a person to appear on his behalf.

For this purpose, “authorised representative” includes a relative, a regular employee, an advocate, a chartered accountant, a cost accountant, a company secretary, or any person with prescribed qualifications.

Click on ‘SAVE & CONTINUE’

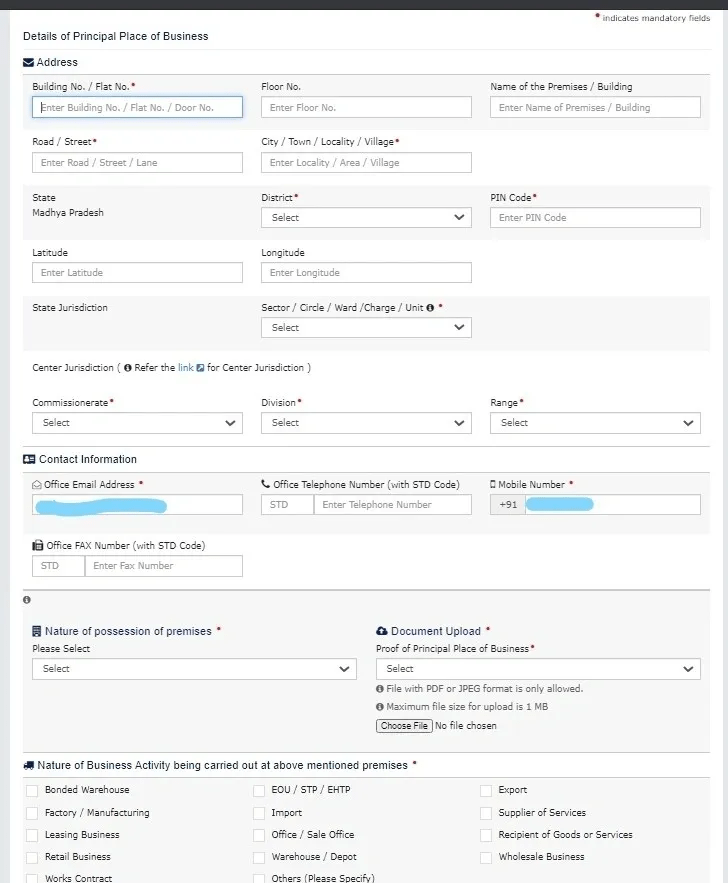

E. Details of Principal Places of Business

- Address – Enter the address of the principal place of business i.e. main address from

which whole business is controlled like Head Office etc. Ignore Latitude and Longitude option. - State Jurisdiction – Mention the state GST jurisdiction for your business address. Select the relevant jurisdiction from the drop-down. If you do not know about your state jurisdiction you can search it on the internet.

- Center Jurisdiction – Mention the central GST jurisdiction for your business address. Select the relevant jurisdiction from the drop-down. If you do not know about your central jurisdiction you can search it on the internet.

- Contact Information – Enter contact information of business.

- Nature of Possession of Premises – Here from drop-down select relevant option i.e. Leased premises, Own Premises, Consented Premises etc.

- Proof of Principal Place of Business – Here from drop-down select relevant proof

of address. It can be electricity bill, rent deed, lease deed, ownership document, property tax receipt, consent letter etc.

Note: Where consent letter from owner or NOC from owner is being used then either electricity bill, property tax receipt etc. of such address shall also be attached with such consent letter or NOC.

- Nature of Business Activity being Carried at the Place – Select the relevant activity which will be performed from such place. More than one activity can be

selected but make sure that the activity mentioned can be carried at such place else

a physical inspection can be conducted by the department and in case of any lapses legal action can be taken. - Additional Places of Business – If you have any other place from where business activities are being carried mention it here. Such place should be in same state in which the principal place is situated. If a person has a business with different trade name in same state then it can be shown as additional place instead of taking separate registration.

Note: If a person has an additional place of business in any other state or UT then a

separate registration in that state or UT is required.

Click on ‘SAVE & CONTINUE’

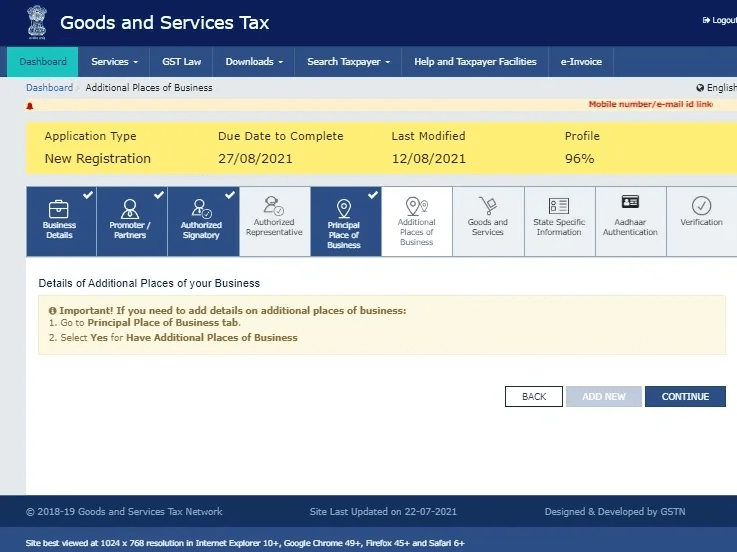

F. Additional Places of Business

Here enter the details of additional places of business, if any. Guidelines from E. Principal Places of Business apply here also.

Click on ‘SAVE & CONTINUE’

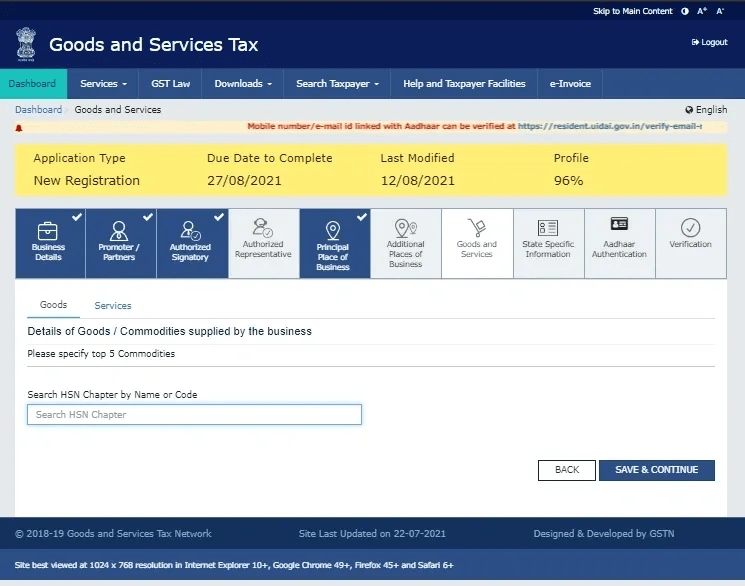

G. Goods and Services – Here specify the top 5 goods or services to be supplied.

Click on ‘SAVE & CONTINUE’

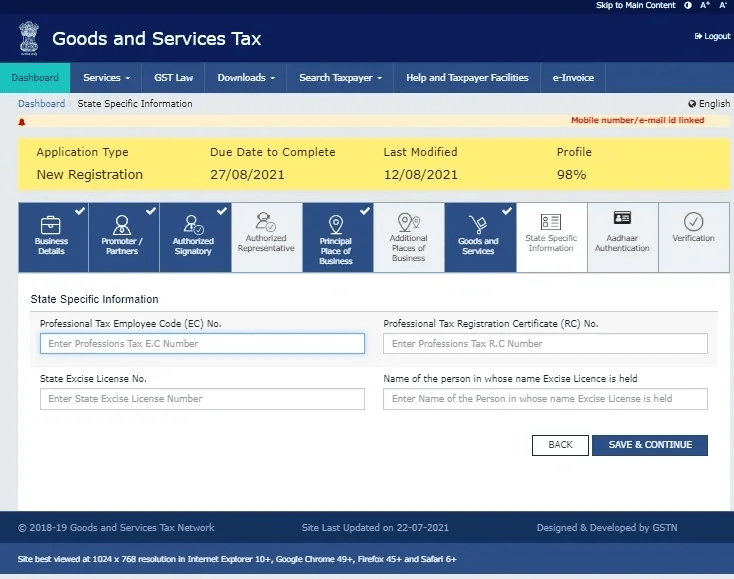

H. State Specific Information – If you have any existing registration for Professional Tax or State Excise or both then mention the details of such registration here.

Click on ‘SAVE & CONTINUE’

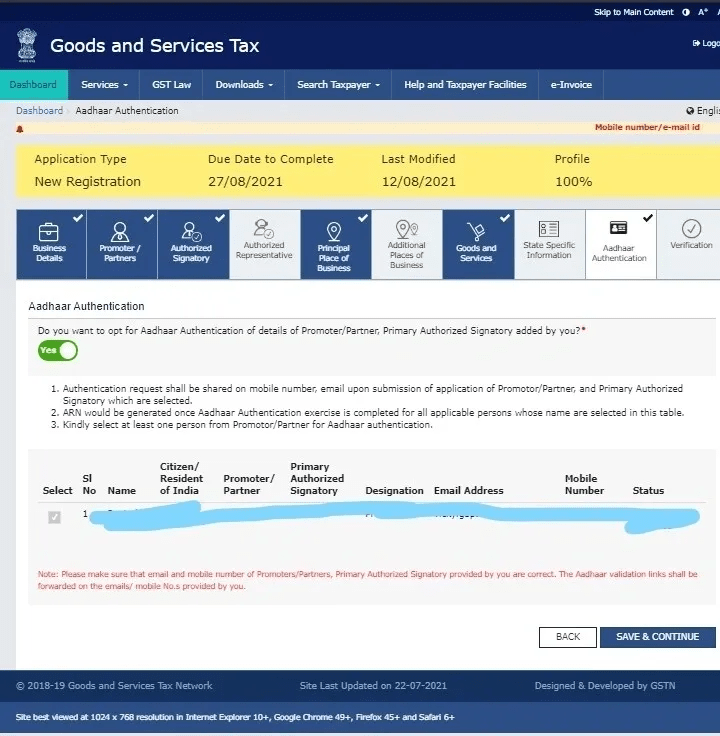

I. AADHAAR Authentication: In this window, you have to select ‘Yes’ or ‘No’ for AADHAAR authentication for promoter/partner etc. and primary authorised signatory.

Where the proprietor, partner, promoter etc. are the primary authorised signatory then only one AADHAAR authentication is required.

But where they are different person then both have to go for AADHAAR authentication.

In our next post, we will learn why AADHAAR authentication is important.

Click on ‘SAVE & CONTINUE’

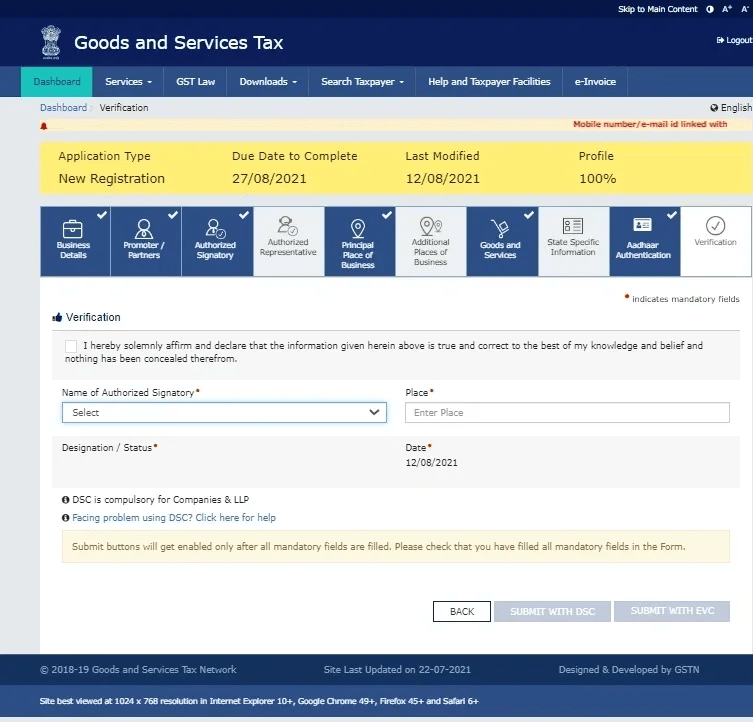

J. Verification – In this window you have to check the declaration, select the name of the authorised signatory, enter the place and then verify the application through EVC or DSC.

EVC is a code that will be received on email and mobile no. of the authorised signatory.

In the case of Company or LLP verification can be done only through the DSC of the authorised signatory.

Click on ‘SUBMIT’

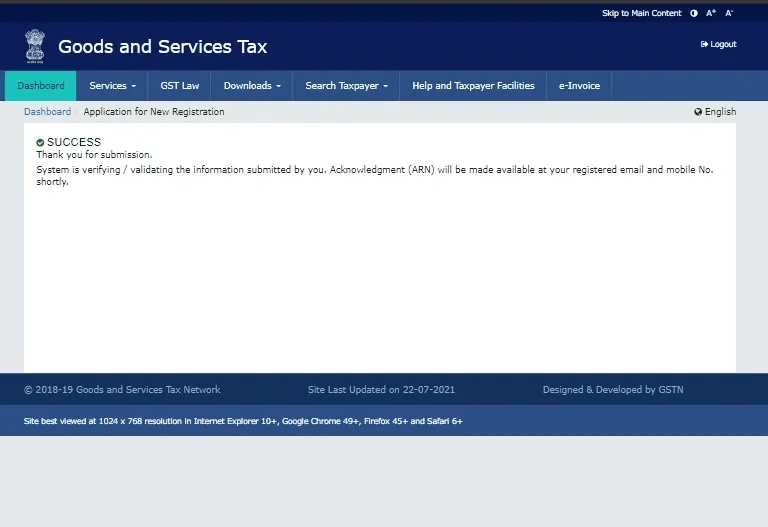

After the verification is complete, the system will verify the information and will send a link for AADHAAR authentication on mobile and the email id provided.

After AADHAAR authentication is complete ARN will be generated and after verification of application registration will be granted.

Where AADHAAR authentication is not opted, the system will generate ARN within 15 minutes of submitting the application after verifying information from the PAN database.

ARN will be sent to registered email id and mobile no.

Why Choose Chhota CFO for GST Registration?

Choosing Chhota CFO for your GST registration in Bangalore offers a range of benefits tailored to meet the specific needs of businesses:

1. Knowledge of the GST Regulation

Among the seasoned professionals on our staff who are familiar with GST laws and regulations are Company Secretaries, cost accountants, and Chartered Accountants. Their extensive background guarantees that your GST registration and compliance needs will be handled accurately and quickly.

2. Using Global Guidelines in a Regional Setting

Because we are situated in Bangalore, we are familiar with the business and regulatory climate there. Their commitment to international best practices guarantees your company’s continued competitiveness and compliance, and their near proximity enables timely assistance and individualized treatment.

3. A client-focused approach Our ability to provide solutions that not only guarantee compliance but also foster the expansion and effectiveness of your company depends on our ability to comprehend your particular business goals and issues.

By opting for Chhota CFO for your GST Registration and related services, you entrust your business to a dedicated partner committed to your financial well-being and success.

Frequently Asked Questions:

What is GST registration?

GST registration is the process of obtaining a Goods and Services Tax Identification Number (GSTIN) from the GST authorities to collect and remit GST on goods and services.

Who is required to register for GST in Bangalore?

Businesses and individuals must register for GST if:

Their annual turnover exceeds ₹40 lakh (for goods) or ₹20 lakh (for services), They are involved in inter-state trade, they are involved in e-commerce or online business, they supply goods/services under reverse charge mechanism, they are involved in the import/export business

How can I register for GST in Bangalore?

GST registration can be done online through the GST portal by submitting the required documents.

What are the documents required for GST registration?

The following documents are typically required:

PAN Card of the business owner, Aadhaar Card of the proprietor/partners/directors, Proof of business registration (Partnership Deed, Company Incorporation Certificate, etc.), Address proof of the business premises (Electricity Bill, Rent Agreement, etc.), Bank account details (Cancelled cheque or bank statement), Digital Signature (for companies and LLPs), Passport-sized photographs of owners

How long does it take to get GST registration?

Once the application is submitted along with valid documents, GST registration usually takes 3 to 7 working days.

Is GST registration free of cost?

Yes, GST registration is free on the government portal. However, professional service providers may charge a fee for assistance.

What is the penalty for not registering under GST?

If a business is liable for GST registration but fails to register, a penalty of 10% of the tax amount due (minimum ₹10,000) is imposed.

How to check the status of my GST registration?

You can check your GST registration status on the GST portal using the ARN (Application Reference Number).

Can I voluntarily register for GST even if my turnover is below the threshold?

Yes, businesses can opt for voluntary GST registration to avail of input tax credit and expand their market reach.

Do I need to renew my GST registration?

No, GST registration does not need renewal. However, if a business is no longer operational, it must apply for cancellation of GST registration.