INCOME TAX REFUND

Income Tax Refund Services in Bangalore At Chhota CFO, we offer expert income tax refund services in Bangalore to assist individuals and businesses in claiming and processing their income tax refunds efficiently. Our dedicated team of tax professionals is committed to providing personalized assistance and ensuring that our clients receive their refunds promptly and accurately. […]

Angel Taxation for startup

Angel Taxation for startups in India Introduction: Angel Taxation for Startup in India, as per the Income Tax Act, refers to the tax imposed on the funds raised by startups from angel investors or other external sources, which are considered as “fair market value” by the Income Tax Department. The primary objective of this provision […]

Letter of Undertaking (LUT) under GST

Letter of Undertaking (LUT) under GST Before understanding the concept of LUT, it is important to understand the meaning of zero-rated supply under GST. What is Zero-rated supply? Zero-rated supply is defined in sec 16(1) of IGST Act. The extract of the same is as follows: “zero rated supply” means any of the following […]

ASMT-10

ASMT-10 What exactly is ASMT-10? ASMT-10 is a form through which scrutiny notice is issued by tax authorities to taxpayers whenever inconsistencies or discrepancies are identified in their filed GST returns (GSTR 1 & GSTR 3B). This form acts as an official means of communication, informing the taxpayer about the identified issues and allowing them […]

Why Your SME Business in India Needs Virtual CFO Services

How to help SME Business Owners in India maintain their day-to-day financial transactions In today’s fast-paced and highly competitive business landscape, small and medium-sized enterprise (SME) owners in India face numerous challenges when it comes to managing their financial transactions efficiently. From handling cash flow to monitoring expenses, SMEs require effective financial management strategies to […]

Questions on Income tax returns

Questions on Income tax returns Query Solution Have you missed filing your income tax return for FY 22-23? If yes, then there is still a chance to file the income tax return within 31st December, 2023. The return missed to be filed within the due date of filing income tax return is known as belated […]

Angel Taxation

Angel Taxation If you are an entrepreneur, you must be aware of the term “Angel Tax”. Under section 56(2)(viib) of the Income Tax Act, a startup in India is required to pay a definite sum in the form of tax. However, in the 2019 Union Budget, the government announced some relaxation. At the same time, […]

SUPPLY CHAIN MANAGEMENT

Suppply Chain Management The management of the flow of goods and services between organizations and locations is known as supply chain management (SCM). The movement and storage of raw materials, inventories for work-in-progress, finished goods, and the complete order fulfilment process from the point of origin to the site of consumption can all be included […]

Vendor Agreement Drafting

Vendor Agreement Services in Bangalore The Indian Contract Act of 1872 defines vendor agreement as a legal document which specifies the terms for the services’ quality, price, liability, duration, and other requirements that the vendor must meet. The entity that has paid for the provided goods is often referred to as the vendor. At Chhota […]

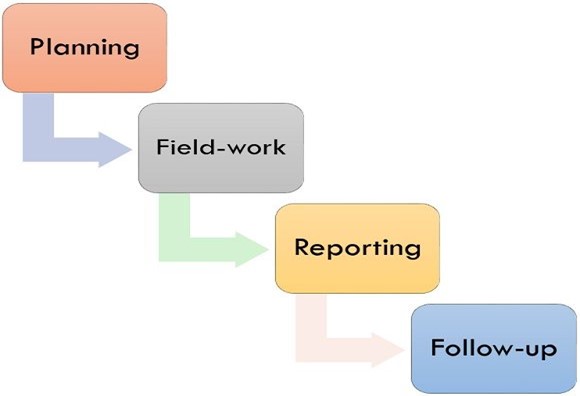

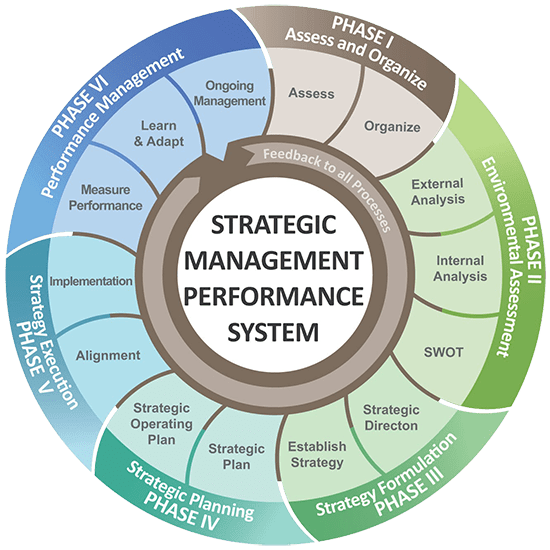

Strategic Planning Services

Strategic Planning Services It includes a definition of the business model, a description of the product or service, goal setting, an analysis of the competitors and the market, financial projections, and a thorough report on business activity. Before meeting with investors, if you have a basic business plan that you would like reviewed by a […]