Income tax Notice services in Bangalore

Even if one has filed your income tax forms before the deadline, they might be shocked to get a letter from the income tax department. They wouldn’t know what it was or how to react to it.

Receiving an income tax notice can be daunting, but our experienced team of tax professionals is here to help. We specialize in providing comprehensive Income tax Notice services in Bangalore to assist individuals and businesses in addressing and resolving income tax notices effectively.

Our team comprises qualified chartered accountants and tax experts with extensive experience in handling income tax notices and resolving tax issues. We offer personalized services tailored to your specific income tax notice, ensuring thorough analysis and effective resolution. We provide representation before tax authorities and assist in responding to notices professionally and promptly.

It is crucial that one first comprehends the distinction between an intimation and a notice The line of distinction between the two is quite thin. One may not be obligated to take any action in response to the notification, which highlights the results of processing your return or the end of the assessment (although there are a few exceptions to it).

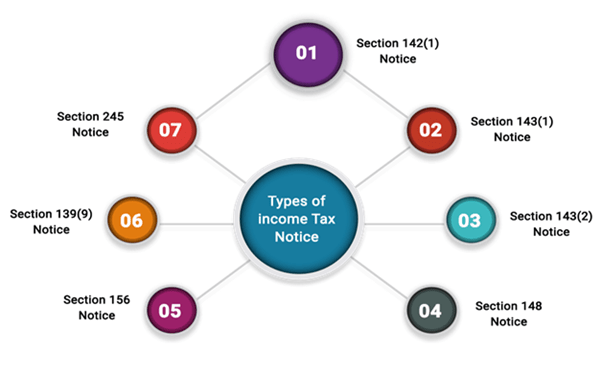

Different Types of Income Tax Notice

1. Notice Under Section 142(1)

A notice under section 142(1) can be issued under two circumstances:

- If you have filed your return, but the assessing officer requires additional information and documents; or

- If you have not filed your return, but the assessing officer wants you to file it.

- The information is called for, to enable the officer to make a fair assessment.

Being non-responsive to this notice has consequences,

- A penalty of Rs 10,000 can be levied for each such failure

- Prosecution which may extend up to 1 year

- Both of the above

2. Intimation Under Section 143(1)

The Central Processing Centre electronically processes ones returns upon filing (CPC). After making the following adjustments to the total income in the return, the income is calculated:

- any arithmetic blunder in the return;

- a false claim, providing the false claim is evident from the information submitted;

- disallowing erroneously stated losses or expenses;

- Any income that wasn’t reported in the tax return.

Upon successful processing of the return /intimation under section 143(1) is issued by the CPC under any of the three instances:

- There is tax liability to be paid;

- A refund has been determined;

- There is no refund or demand, but there is an increase or reduction in the amount of loss.

3. Notice Under Section 143(2)

The goal of this notification is to tell the assesses, that the return filed has been picked for scrutiny. It’s important to keep in mind that the section under which it will be examined differs from the one under which the notice was issued. The assessing officer wants to make sure that users haven’t committed any of the following offences through careful examination:

- Understated your income;

- Claimed excessive loss; or

- Paid lesser taxes

The taxpayer is obligated to answer to the questionnaire and provide the necessary paperwork in response to this notice from the income tax department. This notification must be served by the assessing officer no later than six months following the end of the assessment year to which it applies.

For the AY 2020–21, Rohit, for example, submitted his return on May 20, 2020. Here, a notification under section 143(2) may be given to Rohit no later than six months following the end of the AY in question, or on September 30, 2021. The taxpayer is obligated to answer to the questionnaire and provide the necessary paperwork in response to this notice from the income tax department. This notification must be served by the assessing officer within six months after the conclusion of the

4. Notice under section 148

An assessing officer can have grounds for suspicion that you underreported your income and consequently paid less in taxes because of it. Even if you were required by law to file your return, you might not have done so. This type of evaluation is known as income escaping. According to the facts of the case, the assessing officer is authorised to evaluate or reassess your income under certain conditions. The assessing officer should give the assessee a notice requesting his income return before conducting such an assessment or reassessment. This notification was published for this reason in accordance with Section 148’s guidelines.

Previously, the following deadlines had to be met in order to issue a notification under Section 148:

The Finance Act 2021 was amended, and as of the first day of April 2021, the following conditions must be met before the assessing officer can reopen the taxpayer’s assessment:

- In typical circumstances, up to three years from the end of the relevant assessment year;

- however, if the assessing officer has significant evidence that income of Rs. 50 lakhs or more for a financial year has escaped assessment, the time limit is extended to ten years from the end of the relevant assessment year, but no longer than three years.

5. Notice under section 156- Demand Notice

The Income Tax Department issues this type of notification when the taxpayer owes any tax, interest, penalties, or other amounts. The amount that is unpaid and owed by the taxpayer is specified in each demand tax notice.

6. Notice u/s 139 (9): Defective Income tax return

When processing a return, if the department discovers a flaw, an error, or missing information, it must submit a notification under Section 139(9) to acknowledge the mistake. Department checks the return against the data they already have.

If the response is not filed within 15 days, the return will be deemed invalid and the defective return must be filed within that time frame.

7.Notice under Set off of refunds against tax remaining payable-section 245

A notice u/s 245 can be issued if the officer has reason to think that tax has not been paid for the prior years and he wishes to set off the current year’s refund against that demand. However, the individual must have received adequate notice and a chance to be heard before the demand and reimbursement can be adjusted. 30 days from the day the notification was received, the recipient must reply to the notice. The evaluating officer may assume that the person has given consent if they don’t react within the allotted time and move forward with the evaluation. It is therefore advisable to reply to the notice as soon as possible.