International Transfer Pricing

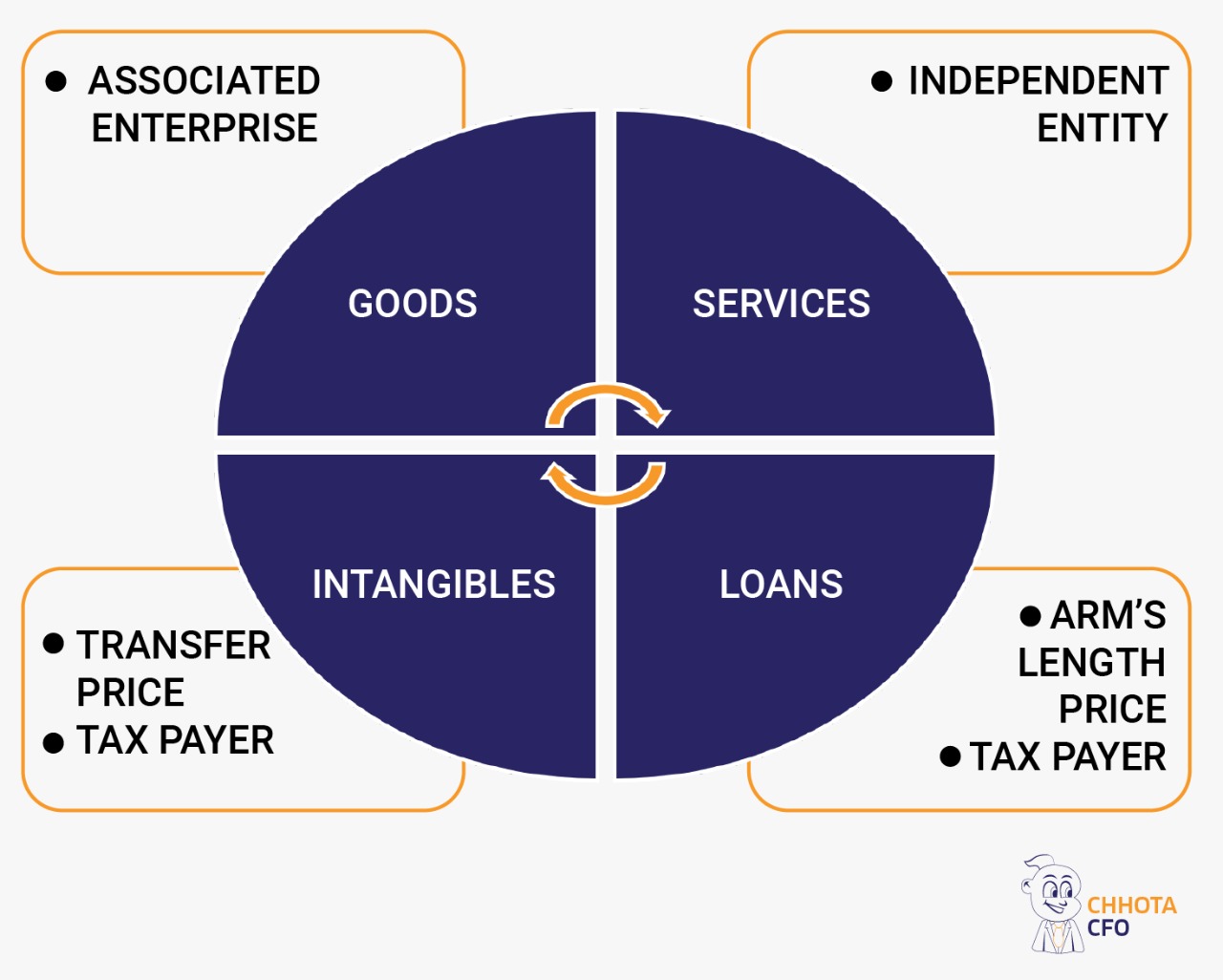

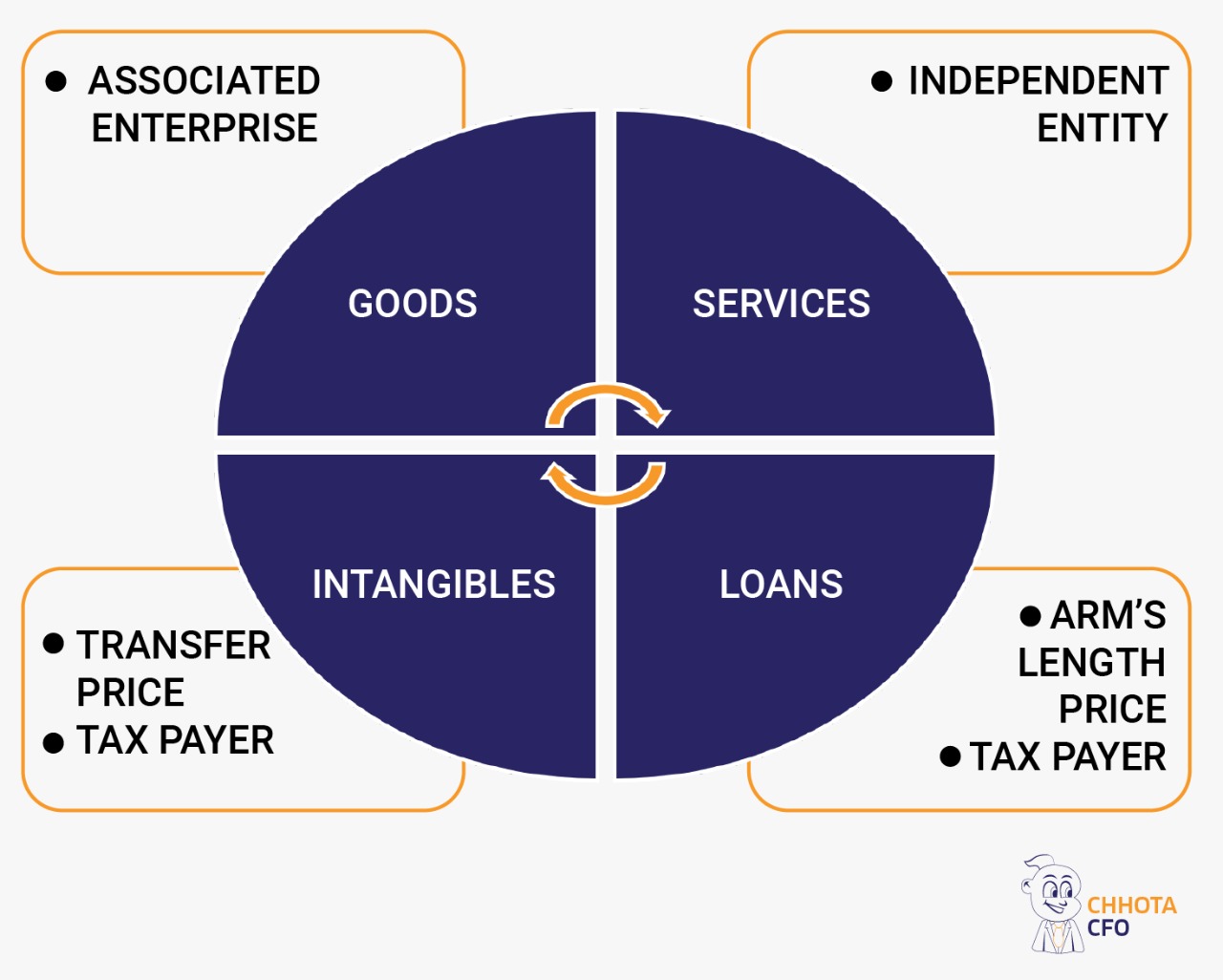

ITP refers to the prices at which a company undertakes cross border transactions with associated enterprises. These transactions can include tangible goods, in tangible property, services and financing transactions.

Every person who has entered into an international transaction and aggregate value of such transactions exceeds Rs. 1 crore during the financial year. In case the aggregate value of such transactions does not exceed Rs. 1 crore, it is not mandatory to maintain the information and documents.

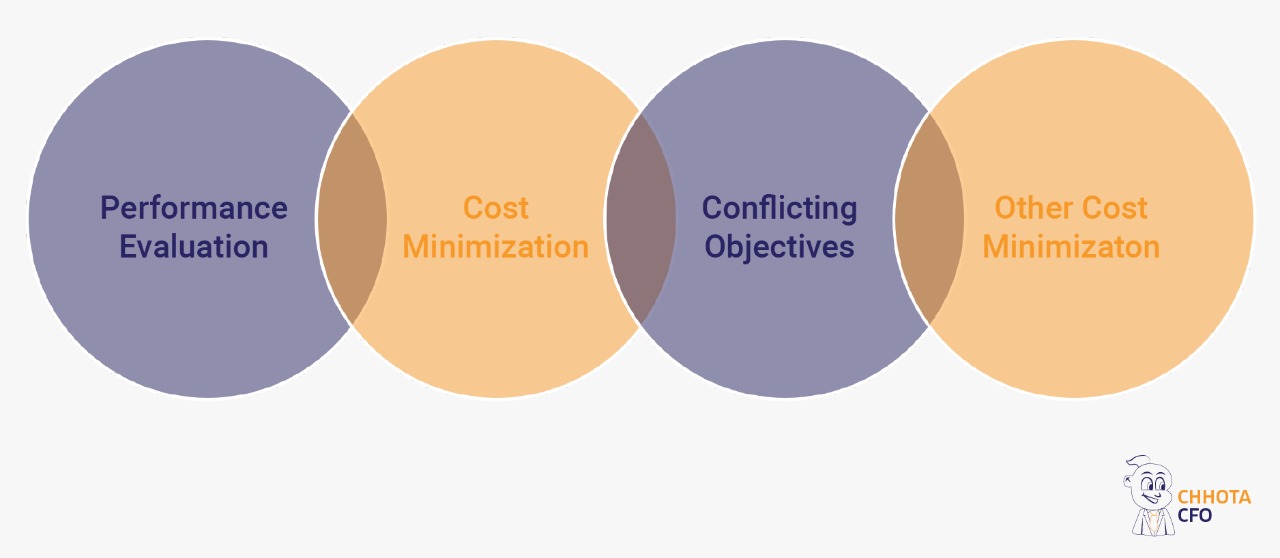

Lowering duty costs by shipping goods into high tariff countries at minimal and transfer prices so that duty base and duty are low. Reducing income taxes in high tax countries by over pricing goods transferred units in such countries profits are eliminated and shifted to low tax countries.

Business enterprises often are organised by division. A division may be a profit centre responsible for revenues and operating expenses or investment centre responsible for also assets.

- Allowing local managers to respond quickly to a changing environment

- Dividing large, complex problems into manageable prices.

- Motivating local managers who otherwise will be frustrated if asked only to implement the decisions of others.

SCHEMES OF TRANSFER PRICING PROVISIONS IN INDIA

- Relevant provisions under section 92

- Computation of income from IT having regard to Arm’s length price

APPLICABILITY SECTIONS

- Associated enterprises – section 92A

- International transaction – section 92B

- Specified domestic transaction- section 92BA

Arm’s length price and documentation sections

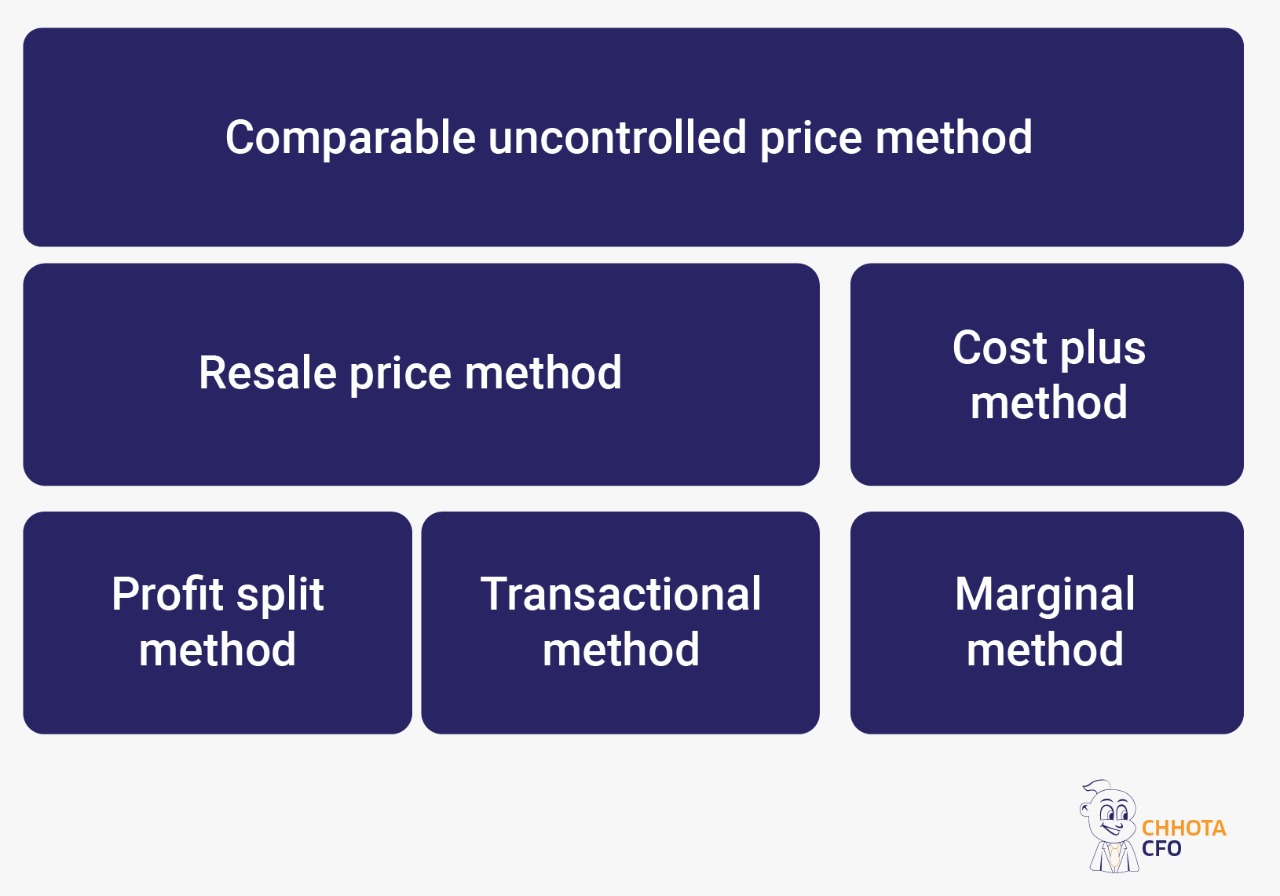

- Arm’s length price section 92C rule – 10A, 10B, 10C, 10CA

- Documentation and certificate – Sec 92D and sec 92E+ Rule – 10D, 10E

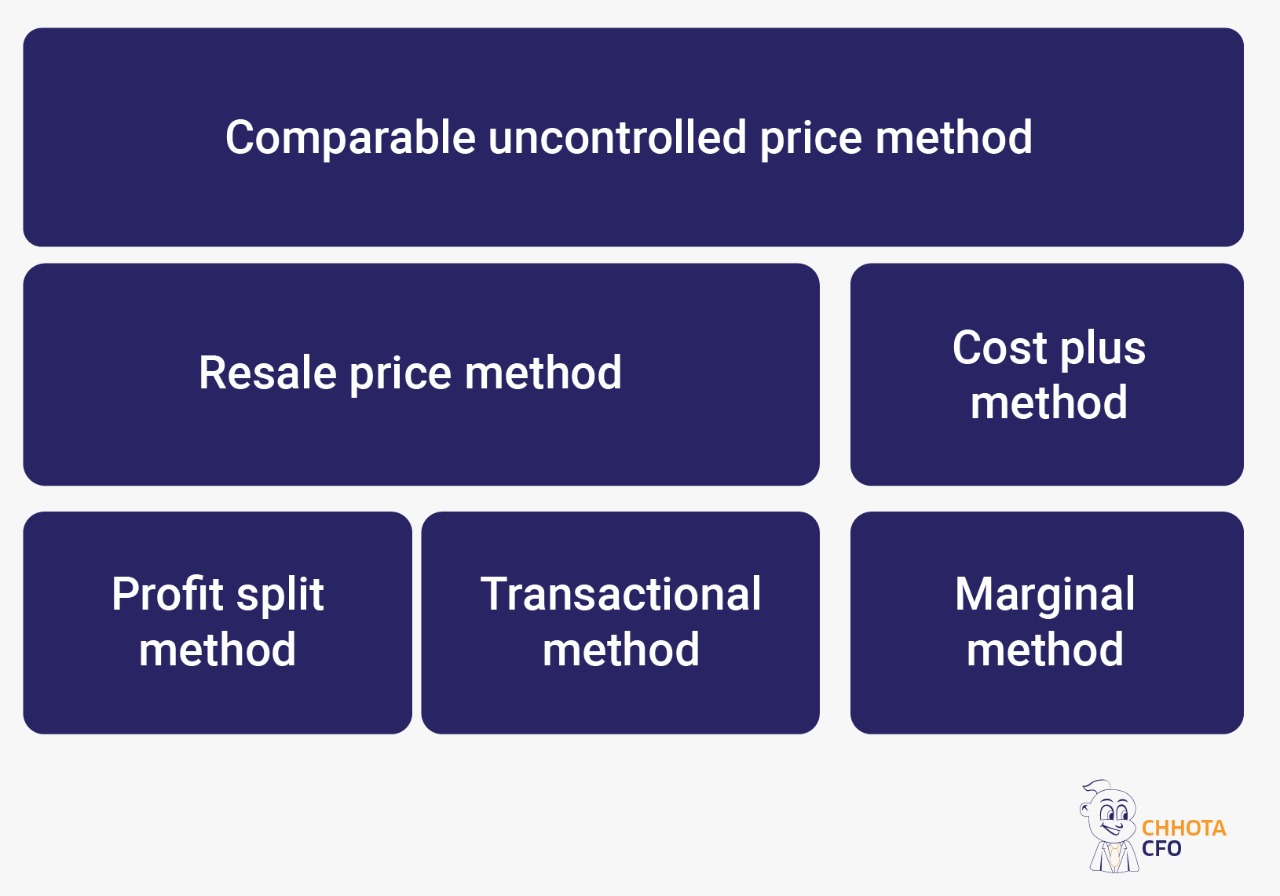

METHODS OF INTERNATIONAL TRANSFER PRICE

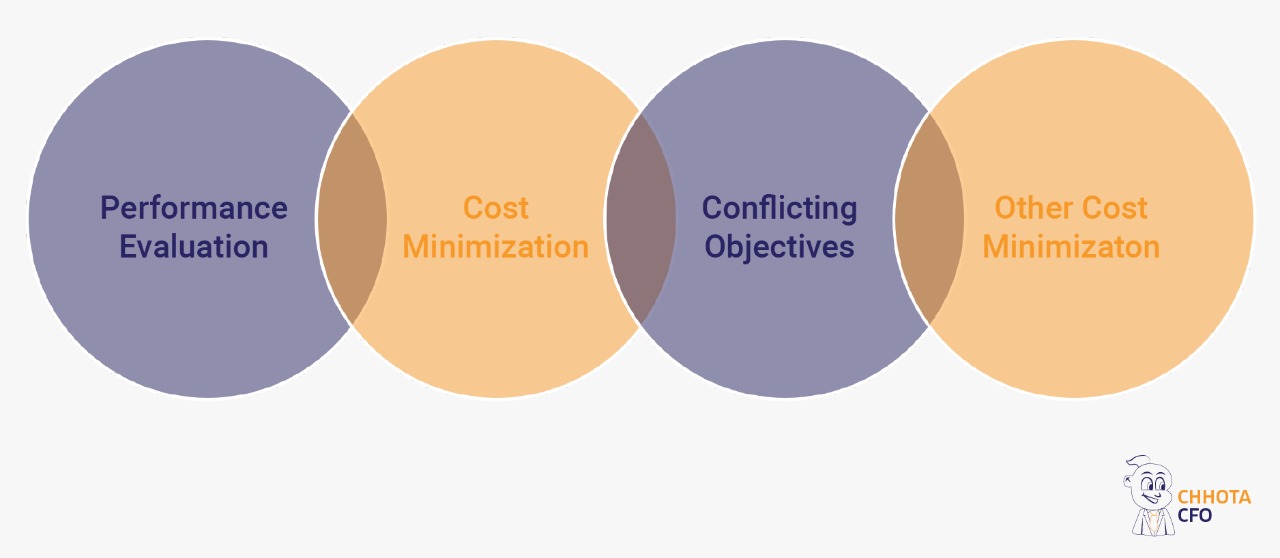

OBJECTIVE OF INTERNATIONAL TRANSFER PRICING

OBJECTIVES OF OTHER COST MINIMIZATION