Domestic Transfer Pricing

It is a transaction other than an international transaction. Transfer pricing provisions on specified domestic transactions, now it is an obligation on the taxpayer to report or documents and substantiate the arm’s length nature of such transaction.

International transfer pricing was present worldwide in both developed and developing countries.

It is a transaction other than an international transaction. Transfer pricing provisions on specified domestic transactions, now it is an obligation on the taxpayer to report or documents and substantiate the arm’s length nature of such transaction.

International transfer pricing was present worldwide in both developed and developing countries.

The income tax ACT, 1916through its section 92-92F, regulates the structure of transfer pricing and deals with cross-border transactions.

TRASFER PRICING FORMULA:

TRANSFER PRICE = OUTLAY COST + OPPORTUNITY COST The transfer price documentation shall be required if the value of international transactions exceeds INR 1 CRORE and specified domestic transaction exceeds INR 20 CRORE in a financial year. it is determined whether the transactions are conducted under market conditions and survive the scrutiny of the IRS and other tax authorities.TYPES OF TRANSFER PRICING:

1. ARM’S LENGTH TRANFER PRICING

Transfer pricing is the arm’s length principle, the price charged in a controlled transaction between two related parties should be the same as that in a transaction between two unrelated parties on the open market.2. DELOITTE TRANSFER PRICING

The professional taxpayer in the home country follows the foreign documentation requirements by preparing transfer price. It is the documentation of reports that analyze the arm’s length nature of their intercompany prices.3. MULTINATIONAL TRANSFER PRICING

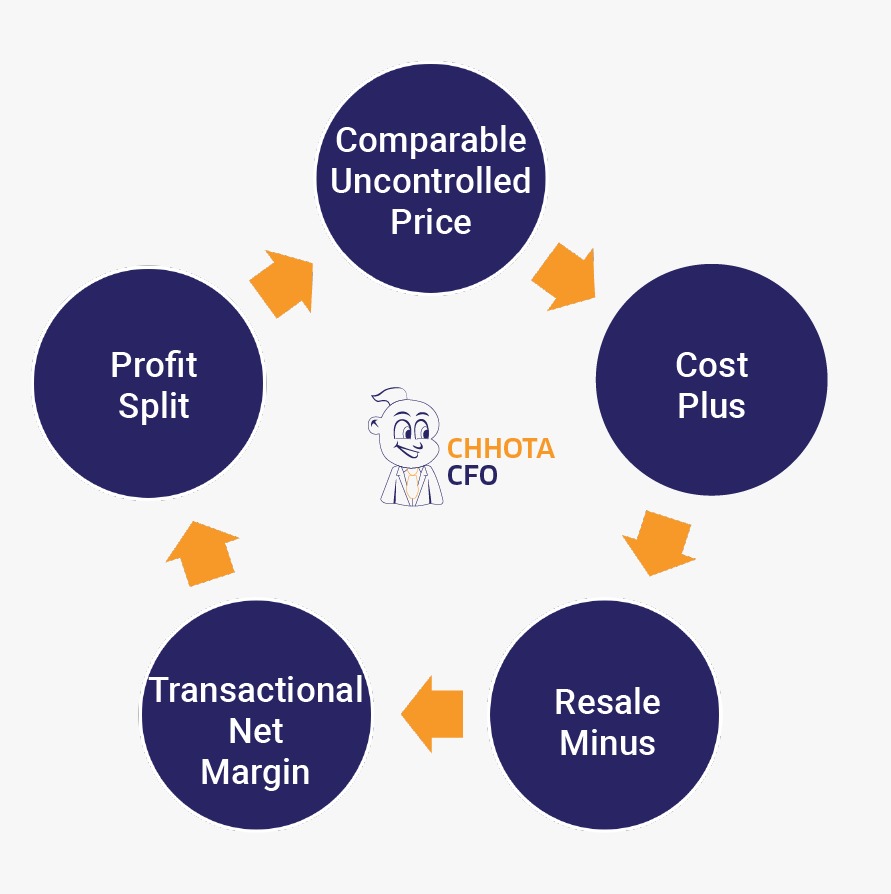

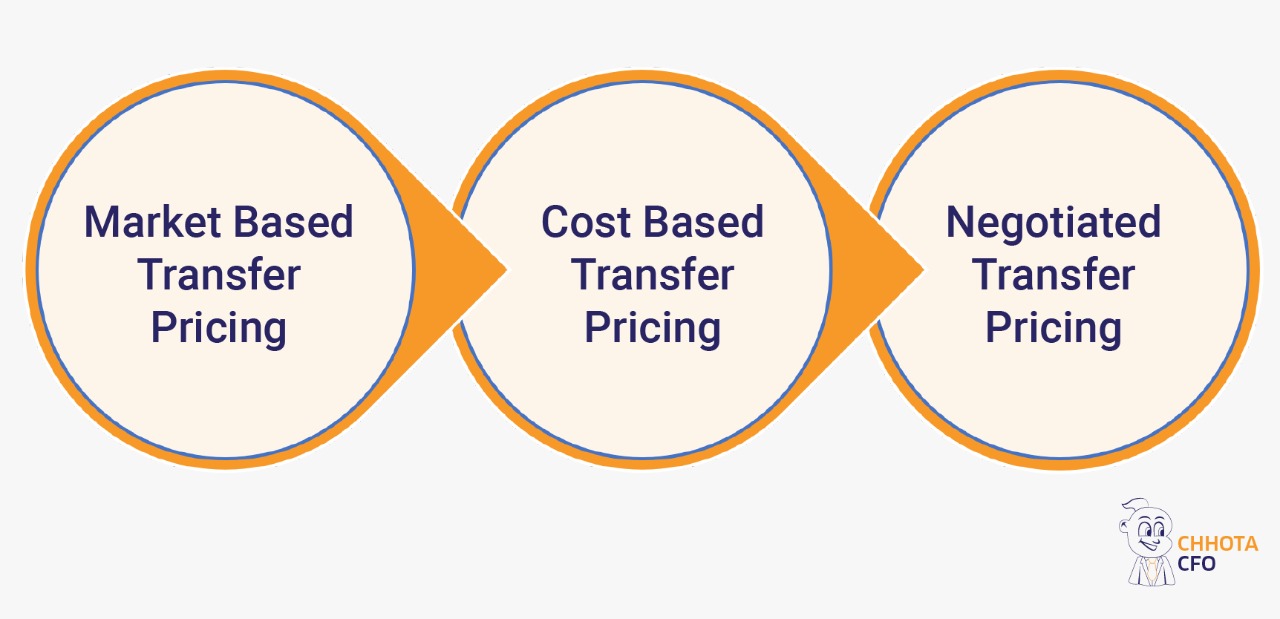

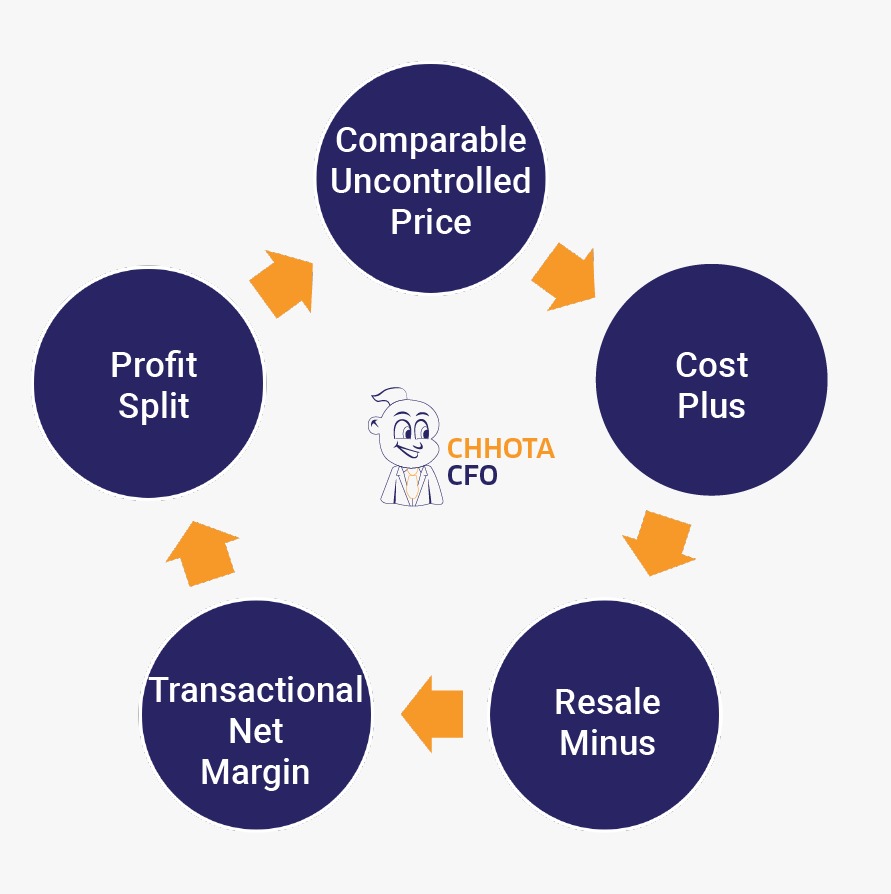

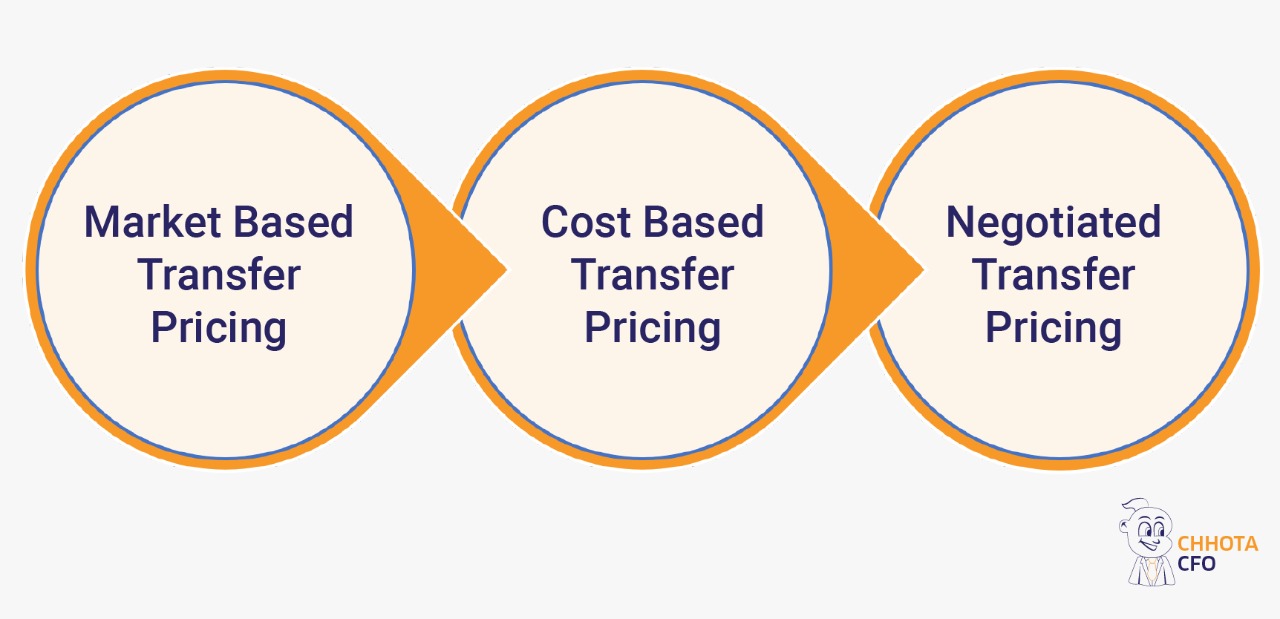

Multinational corporations use transfer pricing as a method of allocating profits among their various subsidiaries within the organizations.TRANSFER PRICING METHOD: