How to make salary slip format excel

It is important to pay the salary of the employees on time for disciplined functioning of a company. In addition to this, it is equally important to keep a record of the payments and details related to that.

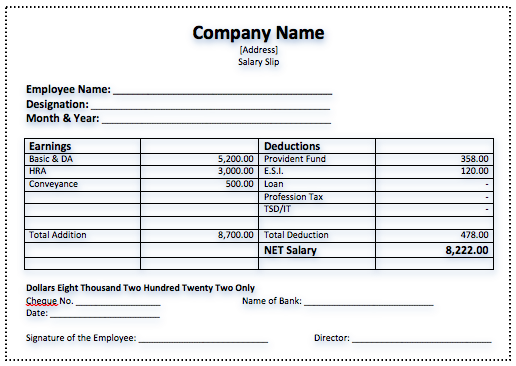

SALARY SLIP

Salary Slip also known as a pay slip, is a form, which is issued by the employer for the employees. This piece of paper is the detailed description of the employee salary components like, Name of the Company, Date of Joining, Pay Slip, Month, Name, Identification Number, Gross Salary, Basic Salary, HRA, TDS, Allowances, PFs, etc. There are also bonus provisions, which is paid on special occasions i.e. once or twice in a year.

Often there are few deductions from the salary for other facilities that are mentioned in the salary slip. This salary payments are usually for a every month and the pay slips are either given through mails or printed in paper. These slips are the proofs of the salary payments to the employees.

Pay slips are basically presented in a tabular form for the clear featuring of all the components. Pay slips are HR payroll documents. This, slips are the inevitable part of the payroll process.

The format of a salary slip is the inclusion of both the earnings and deductions, both fixed and variable. It is also mandatory to include all the tax deductions. This is to keep constant record of the transactions of the company.

Although this process of salary payment is done by the accountant and not by the employer. The accountant of the company takes care of the details that are necessary to include in a pay slip at the end of each month. Thus, any mistake on the part of the accountant can harm the calculation of the entire financial stability of a company causing a threat to his or her job.

IMPORTANT SALARY SLIP EXCEL FORMAT

- Header Company Name

- Employee Details

- Salary Components

- Summary

- Approval and Notes

The components that come under Incomes-

- Basic Salary

- Dearness Allowance

- House Rent

- Conveyance Allowance

- Leave Travel Allowance

- Medical Allowance

- Performance Bonus and Special Allowances.

The components that come under Deductions-

- TDS

- PF

- Standard Deduction

- Professional Tax

- Telephone bills, medical bills, etc.